At the end of the previous week, gold rose the most in five months after the Fed’s chairman Mr. Powell gave a dovish speech at the Jackson Hole Symposium. Although previously the central bank sounded optimistic about the tightening of the monetary policy giving clues on four rate hikes this year, this time the chairman signaled the gradual interest rate rise. That news pulled the US dollar down and helped gold to climb.

This week has started not so shiny for gold. The US dollar index has been trying to recover as a result, XAU/USD has been moving down. The trading isn’t extensive. Therefore, we have a question: does the gold market have chances to surge?

Usually, gold is considered by traders as a safe haven that rises in times of uncertainties. However, as we can see, the gold market was depreciating despite trade wars tensions, Brexit issues, Turkish lira’s fall. Investors preferred the US dollar, yen and Treasuries to gold. What should traders expect from the gold market if its traditional rules are not actual anymore?

Analysts at the Commerzbank believe that the gold market has good chances to surge and it’s early to say that gold has lost its status as a safe haven. According to them, the weakness of gold was caused by the strong USD, the strong US equity market, weak emerging market currencies, and speculative selling. However, the analysts see the soon end of the USD’s rise. If we remember the situation before the crisis of 2008, gold fell to $700 and the USD rose, however, later the gold price surged to $1,200 by December 2009 and $1,400 at the end of 2010.

According to the COT report, hedge funds and managers keep betting on weak gold despite its recent rise. However, Commerzbank’s analysts see this as a positive signal. As the large speculators hold net-short positions for a long time, the reversal moment should happen soon. The bank supposes that as soon as the market gets a fresh catalyst, traders will close positions and the price will go up.

As a result, the bank forecasts a gold’s rise to $1,300 by the end of the year and to $1,500 in 2019.

What about the short term trading?

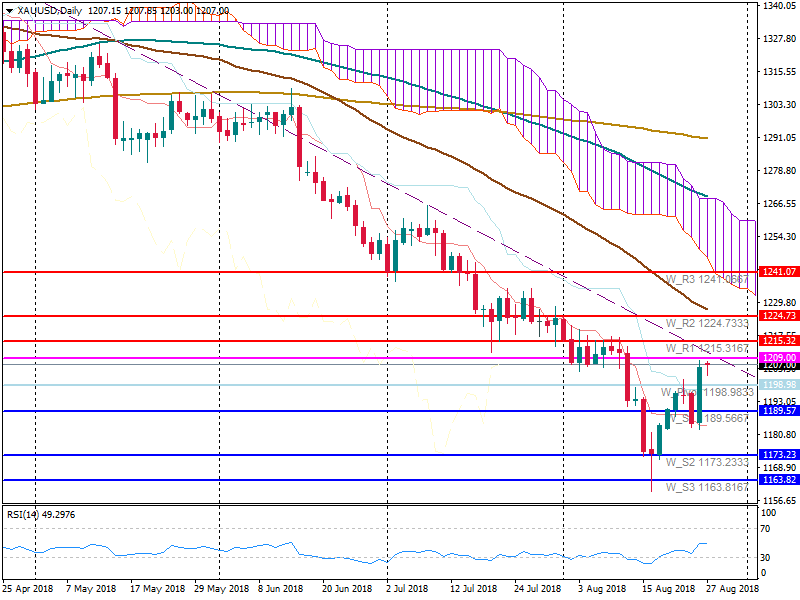

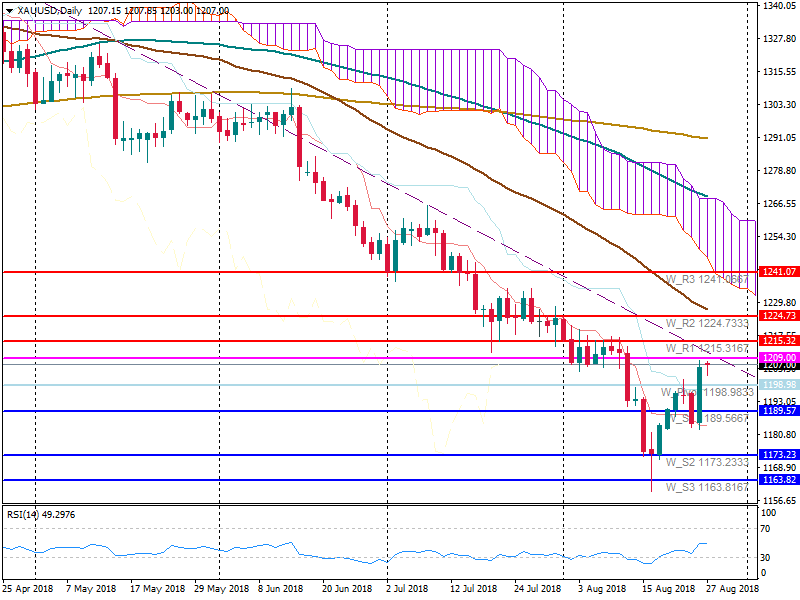

In case, the USD falls further down, gold will have chances to go up. However, the rise may be limited. On H4, the relative strength index is near 70 that means that the XAU/USD pair is nearly overbought. On the weekly chart, MAs are moving in the horizontal direction. It may signal the trading in a sideways trend. The first resistance is at $1,209. The next one will lie at 1,215.32 and will be quite strong for the gold price as 200-hour MA lies at this level. The support is at 1,199 (100-hour MA). If the USD surprises with a great rise, the pair may fall to 1,190.

Making a conclusion, we can say that in the near term the forecast for the gold market remains bearish. However, in the longer term, gold has chances to appreciate. As soon as there is a strong driver for the market, the price will go up.