The Australian dollar shocked with a significant rise on Monday, June 4. The AUD/USD pair traded at a six-week top near 0.7660. The surge was caused by positive economic data. Retail sales’ data was greater than expected (0.4% versus 0.3%). Company operating profits rose by 5.9% to a record in the March quarter, beating expectations for a 3.0% increase. Business inventories were stronger than expected as well, the data increased by 0.7% in the March quarter compared with expectations of 0.1% rise.

However, on Tuesday, the Australian dollar couldn’t stick to new highs, so it declined. The reason is negative economic data. Current account figures were weaker than anticipated. On June 6, traders will look at the GDP growth and on June 7, at trade balance data. If the actual data are greater than the forecast, the aussie will have chances to appreciate again.

The Reserve Bank of Australia continues to keep the interest rate on hold since September 2016 and isn’t anticipated to change the interest rate until the end of 2019. It seems like the compression of Australia rates relative to the rest of the world means the AUD should underperform. The 2-year differential with the US, for example, is at its lowest since 2000 when AUD/USD was close to 0.50. However, it should be taken into consideration that Australia’s terms of trade are substantially higher than there were back then.

As you can see, the Australian dollar rate depends not on the interest rate, but on the economic data. If the Australian dollar is so affected by the economic data, it’s worth to take a closer look at Australian economic conditions.

Analysts at the AMP Capital expect Australian growth in 2018 to be a little below the Reserve Bank of Australia’s forecast because of a constrained consumer and a slowing housing market. They think that the economy is still running below its capacity.

Other analysts predict the annual rate of consumption growth to slow from about 3% in the first quarter to around 2% by the end of the year because of the low wage growth that affects household finances, rising petrol prices, and a slowing housing market. Moreover, companies are still reluctant to reward pay hikes with annual wage growth crawling at around 2%, its slowest pace ever.

What to expect from the Australian dollar in the short-term?

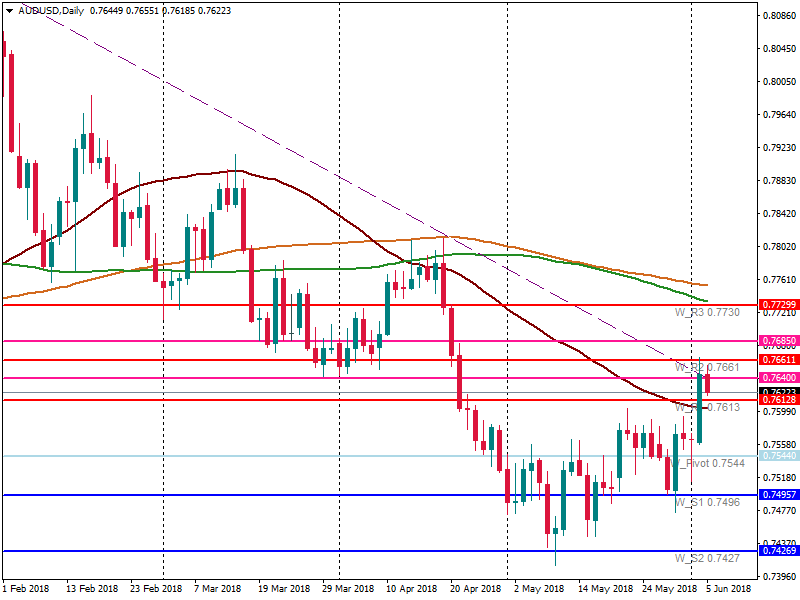

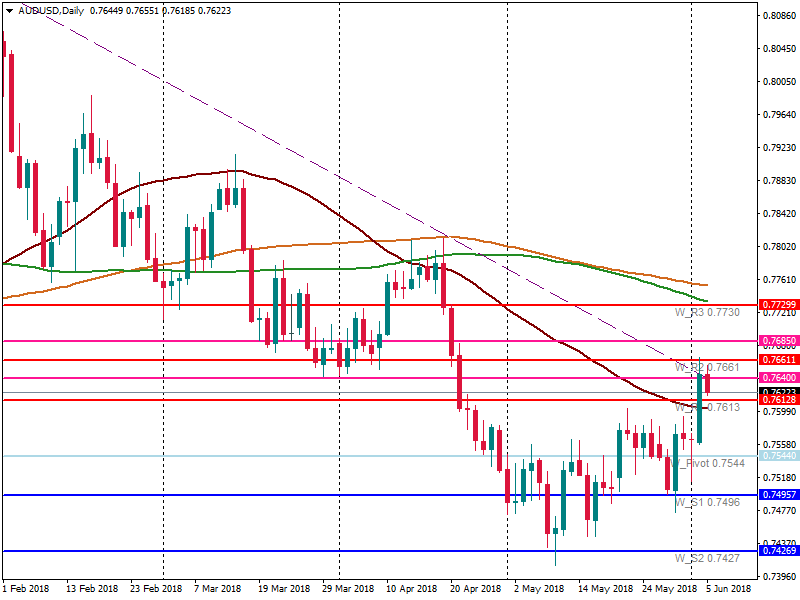

Let’s have a look at the chart.

On Monday, AUD/USD managed to reach the 0.7640 level and close above it. However, Tuesday’s negative economic data pulled the pair down. The further aim for the AUD/USD pair is at 0.7610.

Analysts forecast the Australian dollar to trade within 0.75-0.76 as for the better part of the past three weeks, the Aussie has mostly correlated within $0.75- $0.76. If AUD/USD can’t end the week above 0.7620, a big plunge can be anticipated.

What about the long-term forecast?

However, there is another important factor that may support the Australian dollar. According to analysts, pessimism towards the Chinese economy, Australia’s largest trade partner, is now priced in. The Chinese economy is anticipated to continue suffering, however, this risk is already priced in. The AUD/USD pair is anticipated to trade near mid-0.80s by 2019.

Making a conclusion, we can say that the Australian dollar remains under pressure. As the central bank isn’t anticipated to raise the interest rate in the near future, only positive economic data will support the aussie. However, there are gaps in the Australian economy. As a result, the aussie is anticipated to remain volatile in the near future.