The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

2019-11-11 • Updated

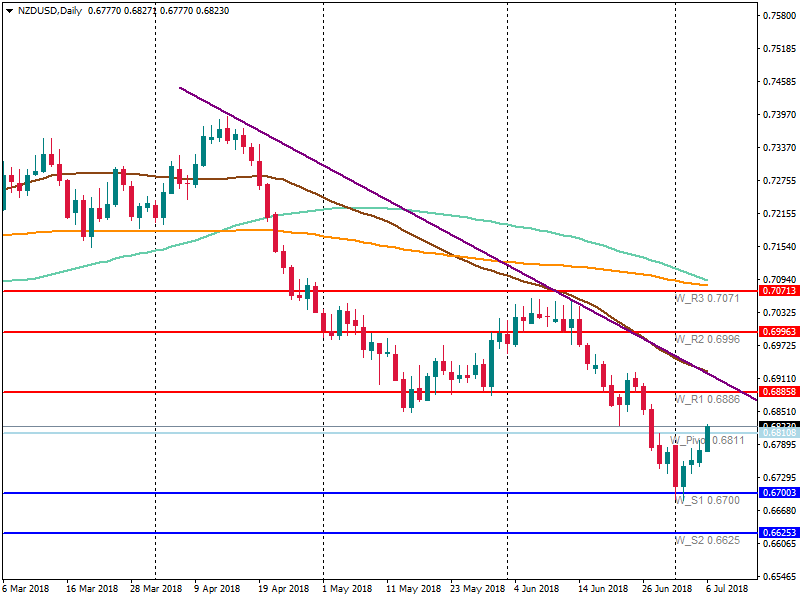

The downward trend of the New Zealand dollar started in the middle of April 2018 and has been continuing until current days. This week the NZD/USD pair reached lows of May 2016. Strengthening US dollar, weak economic data and trade war tensions weigh on the currency.

According to the Bank of New Zealand (BNZ), there are downside risks to kiwi despite the fact that it’s already trading below its fair value.

Despite the negative assessment of the current NZD’s environment, the Bank doesn’t see reasons to be overly bearish. BNZ says that easing commodity prices won’t have a negative impact on the NZ trade. As a result, New Zealand's terms of trade will likely remain close to a record high. Additionally, fiscal stimulus will support growth over the second half so the recent soft data will be just temporary.

Although the BNZ is optimistic about the future of the NZD and the New Zealand economy, other authoritative institutions bet against the NZD.

The International Monetary Fund said that despite recent depreciation, New Zealand's Real Effective Exchange Rate is above its long-term average and the NZD is moderately overvalued. That is not a positive comment for the NZ currency.

According to analysts at JP Morgan, the idea of the rate cuts prevails in the market as the RBNZ recognized unfavorable growth forecasts. As a result, the bank bets to NZD shorts.

ANZ expects a further weakness of the NZD. According to the Bank, the price around current levels is close to where it’s supposed to be fair.

Let’s take a closer look at a technical setup in the near-term.

Up to now, NZD/USD is recovering. The pair managed to break the resistance at 0.6810. The strength of the NZD is based mostly on the weakness of the USD. If the US dollar continues to weaken, the pair will be able to reach the next resistance at 0.6885. The trendline lies at this level, so 0.6885 may become a reversal point for the pair. If the pair reaches the resistance, it will be a good sign to sell. Otherwise, a fall to the support at 0.67 is anticipated.

Making a conclusion, we can say that negative factors for the New Zealand dollar prevail. Even the major institution, the Central Bank, says about risks for the economic growth. It creates a possibility of the rate cut that is highly negative for the domestic currency. Trade wars issues put additional pressure on the commodity currencies including the NZD. Until the New Zealand economy presents more optimistic economic data, the NZD will suffer.

The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

Yes, oil prices are burning right now, and inflation is getting hotter along with it worldwide. However, the oil's bullish momentum is under threat.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!