Turkish leader Recep Tayyip Erdogan won the elections in Turkey in May this year. This term will be his last. The presidential race was not easy for the 69-year-old Justice and Development Party leader. Kemal Kılıçdaroğlu, a supporter of European integration, was stepping on his heels. The ongoing devaluation of the Turkish lira, which over the past three years has decreased against the US dollar by more than 160%, did not add points to Erdogan.

Presidential campaign

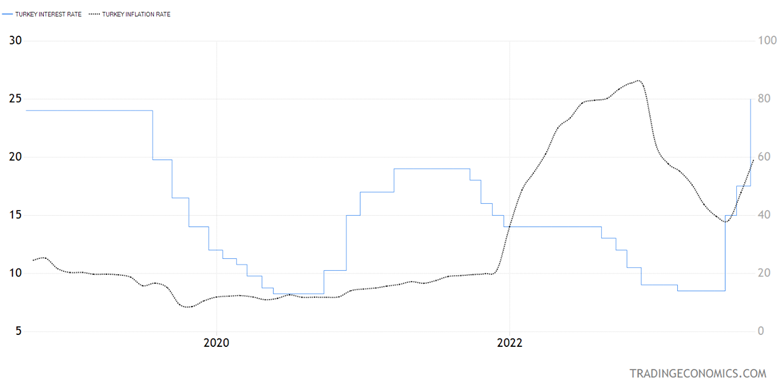

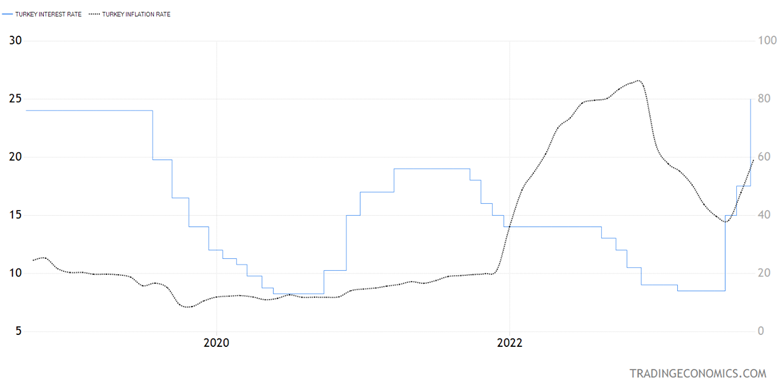

Erdoganomics - this is how Erdogan's policy of keeping interest rates at an extremely low level, despite rising inflation and a depreciating national currency, was jokingly called. From 2021 to 2023, the Central Bank's rate gradually decreased from 19% to 8.5%, ensuring an ever-increasing slide of the real rate into the negative area.

Erdogan did not hesitate to fire three Turkish central bank governors keen to pursue a more balanced monetary policy. What is the reason for such persistence in reducing the real rate?

The first reason is the budget deficit, which by 2020 reached an unprecedented level of 3.5% of GDP in Turkey. By December 2022, i.e., on the eve of the election year 2023, the budget deficit decreased to 0.9% of GDP.

The second reason could be the increased debt by 2021, which amounted to 41.8% of GDP.

The lira depreciation led to a reduction in part of the debt and a drop in the indicator to a more comfortable 31.7% for Erdogan. Note that from 2020 to 2022, Turkey's GDP has grown from $720.29B to $905.99B (an increase of about 26%); at the same time, the debt has grown from about 2T lira to almost 6T, i.e., nearly three times. Most of the debt was absorbed through the devaluation of the lira.

The period of a positive real rate ended in Turkey in 2022, when a price shock in the energy market amid the Russia-Ukraine conflict was superimposed on the systematic monetary easing from the Central Bank of Turkey. Almost a third of Turkish imports are energy products, and Russia is first in imports. S&P Global reported that Turkey has become the third largest buyer of Russian crude after China and India. As a result, the devaluation of the Turkish currency was necessary to increase the volume of purchases in the spot market.

By October 2022, the volume of purchases of energy carriers from the Russian Federation dropped sharply. At the same time, the Turkish Central Bank significantly reduced the step of monetary easing. For Q4 2022 - Q1 2023, the rate was reduced only once by 50 bp. For comparison, from the moment the preparation of the presidential campaign began until the price shock in the energy market, the Central Bank of Turkey lowered the rate by 10%!

Turkey vs. Developed economies

Turkey has traveled the very path that developed economies would like to do now but cannot for at least two reasons:

- Economic. Developed economies simply cannot withstand the kind of overhang of inflation that Turkey can tolerate. The reason for the developed economies was the insane injection of liquidity into the market in the pandemic year 2020 (which Turkey did not do) and the “cancellation” of Russia as a key geopolitical rival, which, however, does not make it a less significant player in the energy market.

- Political. The Turkish political system is much closer to the Russian one, which implies a much greater involvement of political factors and the country's economic environment. The Turkish (and Russian) economy combines political interests woven into macroeconomic processes. Tolerance to inflation, and hence the ability to absorb bubbles in Turkish society is significantly higher than the average European.

After Erdogan's re-election, the spiral needed to be turned differently. It is precisely with this that the appointment of Hafize Gaye Erkan, a “classic monetarist,” to the post of head of the Central Bank is connected. The Central Bank of Turkey raised the rate to 25%.

Erdogan's political victory has taken place; now, it is necessary to consolidate the success by winning an economic victory over inflation. It won't be easy. In August of this year, inflation began to accelerate again (in annual terms, it is almost 59%).

At the same time, on the technical side, the first step to victory has already been taken - USDTRY has stopped falling steeply. The resistance level is at 26.80 liras per dollar; the support level is around 20.80.

If everything happens how Ms. Erkan wants, USDTRY should consistently return, breaking through 24.85 and 23.65. However, let's not rush things.

Try your trading skills