The risk-on sentiment started this week has moved potentially risky investments, such as emergency market currencies, the AUD, the NZD, and the CNH, higher against the American safe-haven – the US dollar. Currently, the Chinese yuan is focusing on the levels of spring 2019. Should we expect further lows or it is just the short-term recovery of the Chinese currency? Let’s hear the analysts’ opinions.

Stimulus talks and election

October is forecast to add volatility to the US dollar for two main reasons. Firstly, the United States enters the pre-election stage. The recent debate between the Democratic candidate Joe Biden and the Republican Donald Trump signaled a possible further escalation of tensions between the candidates ahead of November 3. Thus, we need to be prepared for more unexpected announcements and possibly compromising information. More analysis of the connections between the US election and the USD is presented in the article “TRUMP, ELECTION, USD: Cleveland debate”.

Another thing that is driving the USD crazy is the anticipation of an additional coronavirus stimulus package. According to the US Treasury Secretary Steven Mnuchin, he and the House Speaker Nancy Pelosi made progress in stimulus talks last week. Despite that, the House of Representatives voted for a delay of a stimulus bill yesterday in order to give more time to Mr. Mnuchin and Ms. Pelosi for discussions. For now, the Democrats persuade the Republicans to agree on the $2.2 trillion stimulus package. This is $1 trillion more expensive than the proposal by the Republicans. The next vote in the House of Representatives is scheduled for today. As a result, nothing is certain. If the policymakers fail to reach an agreement on support measures, the risk aversion will strengthen the USD.

Forecasts and technical outlook for USD/CNH

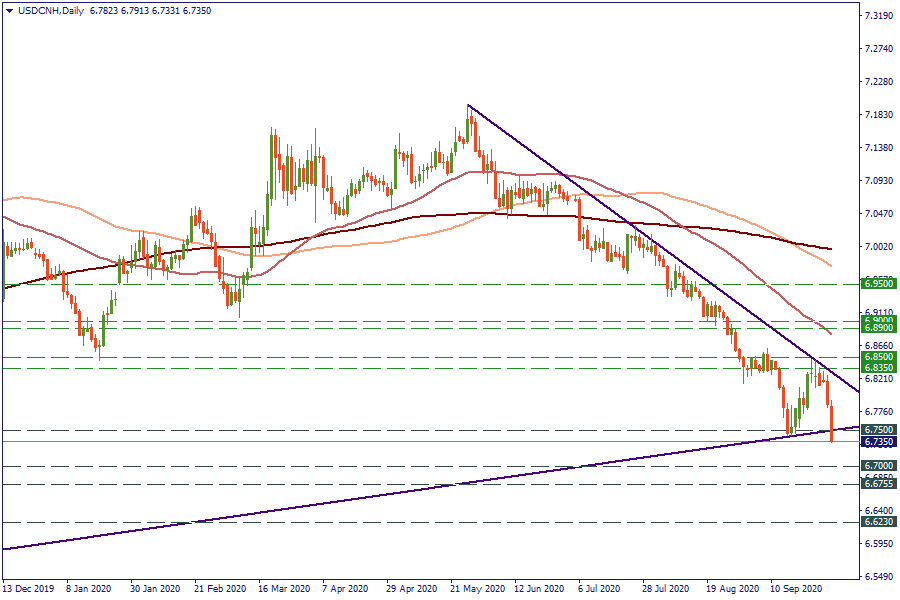

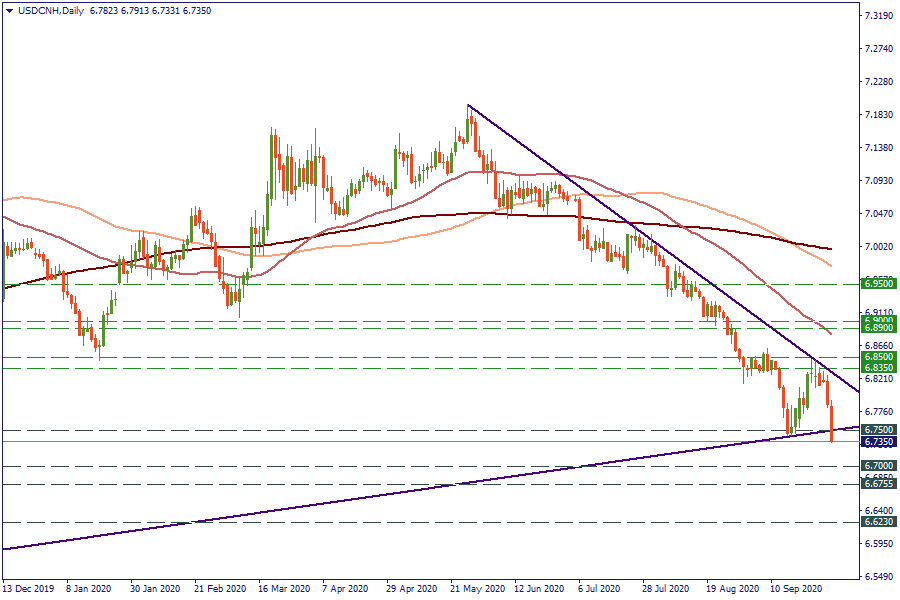

On October 1, USD/CNH has broken below the low of September 16 at 6.75 and started to go down towards the 6.7 level. If the USD gets positive momentum today, the pair will return above 6.75 level to the resistance at 6.8350. This scenario will go in line with the forecast by UOB Group, which expects consolidation between 6.75 and 6.8350 for the next 1-3 weeks. Alternatively, an agreement on stimulus may pull the pair to the low of April 2019 at 6.7. The breakout of that level will trigger further selling pressure towards the next strong obstacle at 6.6755.

TRADE NOW