The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

2022-12-16 • Updated

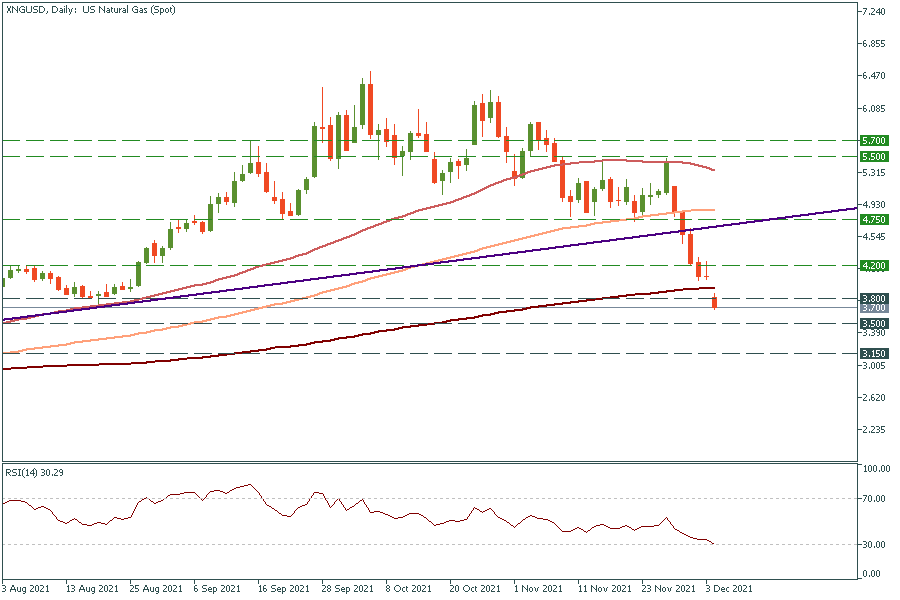

Last week, the price of US gas had posted three days of heavy falls. The gas slumped from the highs near $5.5/mmBtu to the lows of $4/MMBtu near the 200-period MA. On Monday, the energy asset opened with a gap below the 200-day moving average. What is going on with this energy asset these days, and should we prepare for further falls?

Currently, the gas price is driven by geopolitical news and the overall risk sentiment in the markets. For sure, the most impactful events for the gas’ price have been happening in Europe. The gas prices in Europe were boosted to an all-time high above 1900 amid the energy crisis in the region and political uncertainties related to a delay in launching of Russia’s Gazprom pipeline called Nord Stream 2. In addition, the certification requirement of Nord Stream 2 in Germany slowed the gas distribution in Europe and pushed the gas prices up. At the same time, the newly identified omicron strain created uncertainties in the market. The risk-off sentiment resulted in investors rebalancing their portfolios and withdrawing their funds from risky assets. As commodities are traditionally viewed as risky investments, gas prices reacted with falls.

Another factor that pulled the gas price down last week was the forecast for warmer winter in North America. The weather outlook for December, January, and February suggests higher temperatures in several US regions. It is a bearish factor for gas.

Given the indeterminacy around the gas supplies coming from Russia, the price has a high chance of an upcoming reversal. However, a clearer picture will be visible within a couple of days. Technically, the gas price gapped below the 200-day MA and tested the support of August at $3.8/mmBtu. Buyers may try to fill in this gap and push the price back to the resistance of $4.20/mmBtu. However, a plunge below the support of $3.8/mmBtu will signal a continuation of the downtrend. In that kind of scenario, the next support will lie at $3.5/mmBtu with a further plunge to $3.15/MMBtu.

Note that if you want to trade gas with FBS, you must choose XNG/USD in MetaTrader or FBS Trader.

The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

The past two years have seen the biggest swings in oil prices in 14 years, which have baffled markets, investors, and traders due to geopolitical tensions and the shift towards clean energy.

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!