Usually, traders pay attention to major currencies such as USD, EUR, GBP and etc. But what about exotic currencies? The South African rand is the emerging market currency that deserves our attention.

In this article, we will consider the opportunities USD/ZAR and GBP/ZAR offer traders.

USD/ZAR

The significant strengthening of the US dollar caused a fall of other currencies especially emerging market ones. Since the US dollar stabilized, the picture for the EM currencies started to become clearer.

The South African rand had been suffering since the end of March 2018 to the middle of June. Up to now, the ZAR has been trying to recover using the stability of the USD. Does it have chances?

Last Tuesday South African President Cyril Ramaphosa announced the decision to amend the constitution to allow land expropriation without compensation. The land reform is very important for the country. On the one hand, this is a step forward. Yet, this new development creates uncertainty as it’s not clear how smoothly the process will go. As a result, the news caused worries among traders and made the ZAR highly volatile.

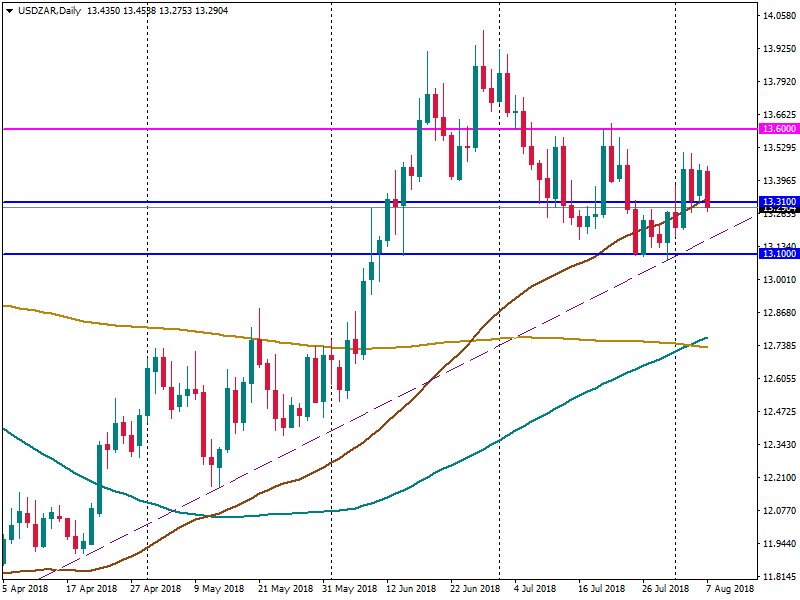

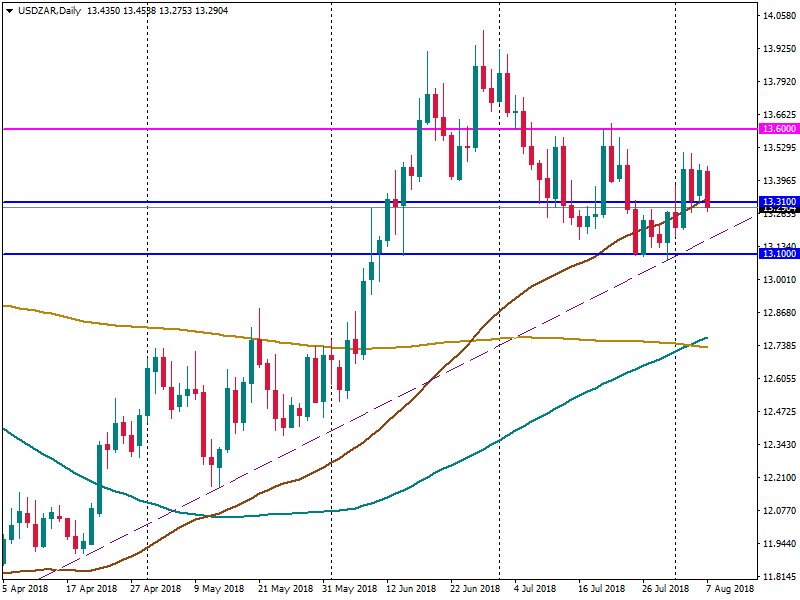

On August 7, South Africa's June manufacturing output was released. It increased at a slower pace than was forecasted. Moreover, this figure isn’t enough to avoid the weakening of GDP data (-2.2% against 3.10% previously). However, despite the weak data, the rand strengthened making USD/ZAR fall. The pair is trying to break below the 50-day MA (a brown line on the chart).

The strengthening of the means that the weakness of the US dollar plays the major role in the direction of the USD/ZAR pair.

Further moves of the USD will affect the pair. Moreover, in the upcoming days, the market will follow releases on the land expropriation issue. Escalation of worries around the land issue and strengthening of the USD will push the pair up toward 13.60. The weakness of the USD will pull the pair to the bottom line of the channel at 13.10.

GBP/ZAR

The British pound is not as strong as the US dollar because of the uncertainties around the Brexit deal. On August 7, the ZAR has managed to appreciate not only against the USD but also against the GBP.

The market is waiting for the release of the South African business confidence data on Wednesday. The forecast is encouraging. Therefore, if the actual data is greater than the forecast, the pair will fall further. The next support is at 17.

Does the GBP have chances to recover? This week, the market is waiting for Friday data. British GDP, Prelim GDP and manufacturing production figures will determine the direction of the pound. The forecast is mixed but if the actual data are greater than the forecast ones, the GBP will appreciate.

In case of the positive economic data and increasing worries around the land issue, the pair will go up. The resistances are at 17.45 and 17.7050.

Making a conclusion, we can say that although the South African economy suffers (GDP rate is negative, manufacturing production output is weak, the country’s net foreign reserves decline), the central bank isn’t anticipated to cut the interest rate. It’s a positive signal for the ZAR. However, the further direction of the USD/ZAR pair will depend on the strength of the USD. Against the British pound, the ZAR has more chances to appreciate. However, strong economic data may encourage the GBP, so don’t forget to check the economic calendar.