Bank of England – Key Rate Update (as of August 6, 2025)

- Official Bank Rate: 4.25% as of the June 19, 2025, Monetary Policy Committee (MPC) decision.

- Recent change followed a cut from 4.50% in early February, marking a cautious shift toward easing after a prolonged tightening cycle in 2023–2024.

August MPC Meeting Outlook

- The MPC is widely expected to reduce the Bank Rate by 25 basis points to 4.00% on Thursday, August 7, making it the fifth rate cut since August 2024.

- Key drivers: Slowing labor market conditions, rising unemployment (~4.7%), and cooling wage growth are weighed against still-elevated inflation (~3.6% y/y)—well above the 2% target.

- Committee split: MPC members remain divided. Dovish voices favor continued cuts, while hawks urge caution given persistent inflation, likely leading to a split vote on the modest 0.25% reduction.

Economic Context & Policy Drivers

- Inflation: June CPI rose to 3.6%, sustained by food price increases. While inflation has eased from 2022 highs (>11%), it remains above the BoE’s target. Long-term inflation expectations have drifted higher, raising sensitivity to premature easing.

- Labor market weakness: Unemployment is climbing to 4.7%, the highest in nearly four years. Job vacancies and wage growth are slowing, increasing pressure on the MPC to ease.

- Growth outlook: Business sentiment is mixed, and consumer spending shows signs of strain, reinforcing concerns about near-term growth momentum.

Policy Forecast & Economic Implications

- Next rate moves: After the anticipated August cut to 4.00%, economists and institutions—like Deutsche Bank, ING, and the IMF—forecast another cut in November or through early 2026. Depending on inflation and unemployment trends, the base rate could eventually ease to 3.50% or lower.

- Monetary Policy Committee division: The MPC faces a growing split, ranging from advocates of deeper cuts to those prioritizing inflation control, with Governor Andrew Bailey and swing members holding the balance.

Economic implications:

- Lower rates ease mortgage and corporate borrowing costs, supporting spending and growth, especially in a cooling labor market.

- However, premature rate reductions risk reigniting inflation, especially via sticky food and service prices.

- A gradual cut path balances easing pressures without compromising efforts to anchor inflation expectations.

The Bank of England appears poised to deliver another quarter-point rate cut this Thursday, trimming its Official Bank Rate to 4.00%—the fifth such move since August 2024. The Monetary Policy Committee (MPC) is navigating a delicate balancing act: reviving a faltering labor market and cooling economy while avoiding the risk of reawakening inflation, which remains stubbornly above target at 3.6% year-over-year.

June’s decision to hold at 4.25% came after a February cut from 4.50%, signaling a cautious pivot away from the aggressive tightening that marked 2023–2024. However, with unemployment climbing to a four-year high of 4.7% and wage pressures softening, momentum is building for continued easing.

Still, the MPC remains split. Dovish members argue the economy needs relief, while hawks warn that sticky food and service inflation—and rising long-term inflation expectations—warrant restraint. Thursday’s anticipated 25-basis-point move is expected to pass by a narrow margin.

Markets now price in another rate cut before year-end, possibly by November, which could bring the base rate closer to 3.50% if disinflation persists. Yet policymakers remain wary of moving too quickly, mindful of the risk that premature easing could reignite price pressures.

The bottom line is that the BoE will likely lower rates to 4.00% this week, driven by labor market weakness and fading growth momentum. However, with inflation still above target and the MPC sharply divided, future cuts will be gradual and conditional on clear signs of sustained disinflation.

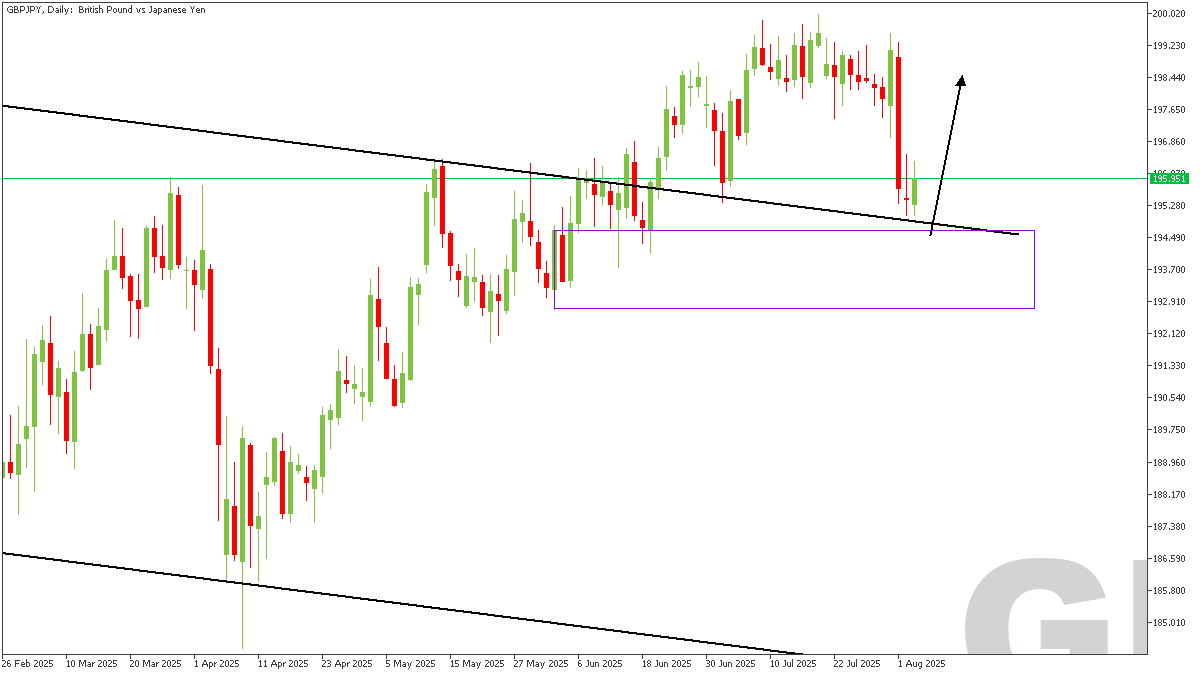

GBPJPY D1 Timeframe

On this GBPJPY Daily chart:

Prices recently broke above a descending channel, which had capped prices for several weeks. After the breakout, it pulled back into a key demand zone between 193.70 and 195.00, aligning with prior structure support and the retest of the trendline — a classic break-and-retest setup. We also see a strong lower wick on the most recent daily candle, signaling buyer interest at this zone. Notably, the structure around 195.35 is being defended — the same level that previously acted as resistance during the rally. While price is still below recent highs, the reaction off this demand area could initiate the next bullish leg, especially if momentum continues to build from here.

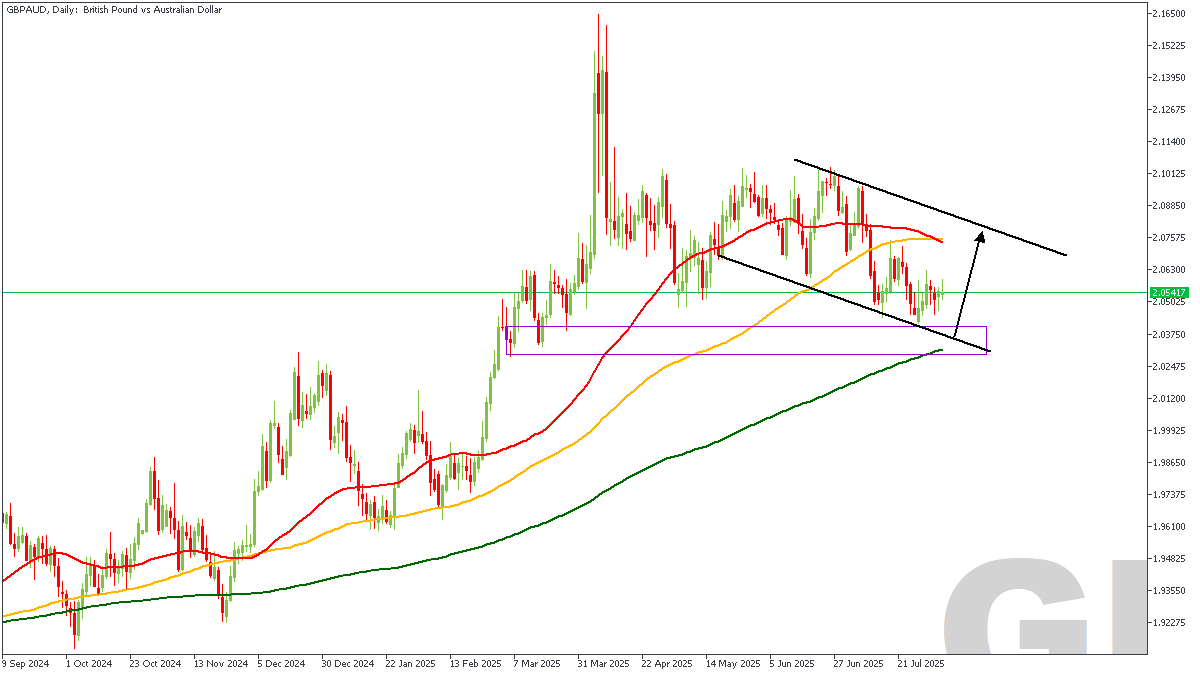

GBPAUD D1 Timeframe

Technical Analysis

- Current Trend: Price is consolidating in a descending channel after a strong bullish rally.

- Chart Pattern: A bullish falling wedge pattern forms, with price bouncing from the lower boundary.

- Support Zone: The purple zone (around 2.0350 – 2.0450) has held as a strong support area multiple times, showing signs of accumulation.

- Moving Averages:

- 200 MA (green): Rising, providing dynamic support below the current price.

- 100 MA (yellow): Flat, acting as mid-range resistance.

- 50 MA (red): Sloping down, showing short-term bearish pressure.

- Candle Action: Recent bounce off wedge support and support zone shows bullish rejection wicks.

Fundamental Factors Affecting GBPAUD

- GBP drivers:

- Sticky UK inflation has kept the BoE hawkish, supporting GBP.

- The UK economy is stabilizing but still showing patchy growth.

- AUD drivers:

- Weak Chinese data and falling iron ore prices weigh on AUD.

- RBA is cautious on rate hikes, with dovish undertones.

These fundamentals suggest bullish pressure on GBP and bearish pressure on AUD, aligning with the possible wedge breakout.

Key Takeaway for Traders

Price is at a technical inflection point. A breakout above the descending wedge could lead to a bullish move toward 2.0950–2.1050.

Trading Plan

- Setup: Breakout of falling wedge pattern

- Entry Trigger: Daily close above the wedge resistance (~2.0650)

- Target 1: 2.0880 (mid-range)

- Target 2: 2.1050 (top of channel)

- Stop Loss: Below the wedge support at ~2.0340

- Invalidation: A daily close below 2.0340 suggests more downside or a false breakout setup.

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.