1. Demand Revival Faces Inventory Headwinds

Natural gas markets are caught between tightening supply and seasonal oversupply. Sweltering summer temperatures and elevated LNG exports drive strong demand, while subpar US storage levels set the stage for a potential winter surge. Analysts warn that front-month prices could top $5/ 5/MMBtu later this year, marking the most substantial rally since 2022.

2. Seasonal Injection Cycle Cools Short-Term Hype

Despite bullish fundamentals, the market faces near-term pressure. July storage injections are on pace to lift inventories above the five-year average, limiting price momentum. For now, spot prices remain trapped in a $2.50–$3.20 fair-value range.

3. Technical Picture: Compression Inside a Channel

Natural gas continues consolidating above $3.00, with overhead resistance at $3.85–$4.00. Price action remains within a descending channel, although bulls are eyeing a breakout toward $3.30–$3.65 if momentum strengthens

Summary:

XNGUSD is range-bound near $3.00–$3.40. Structural demand and export tailwinds could eventually lift prices toward $4–$5. But for now, ample summer stocks and seasonal pressures may cap rallies unless surprise cold or supply disruptions emerge.

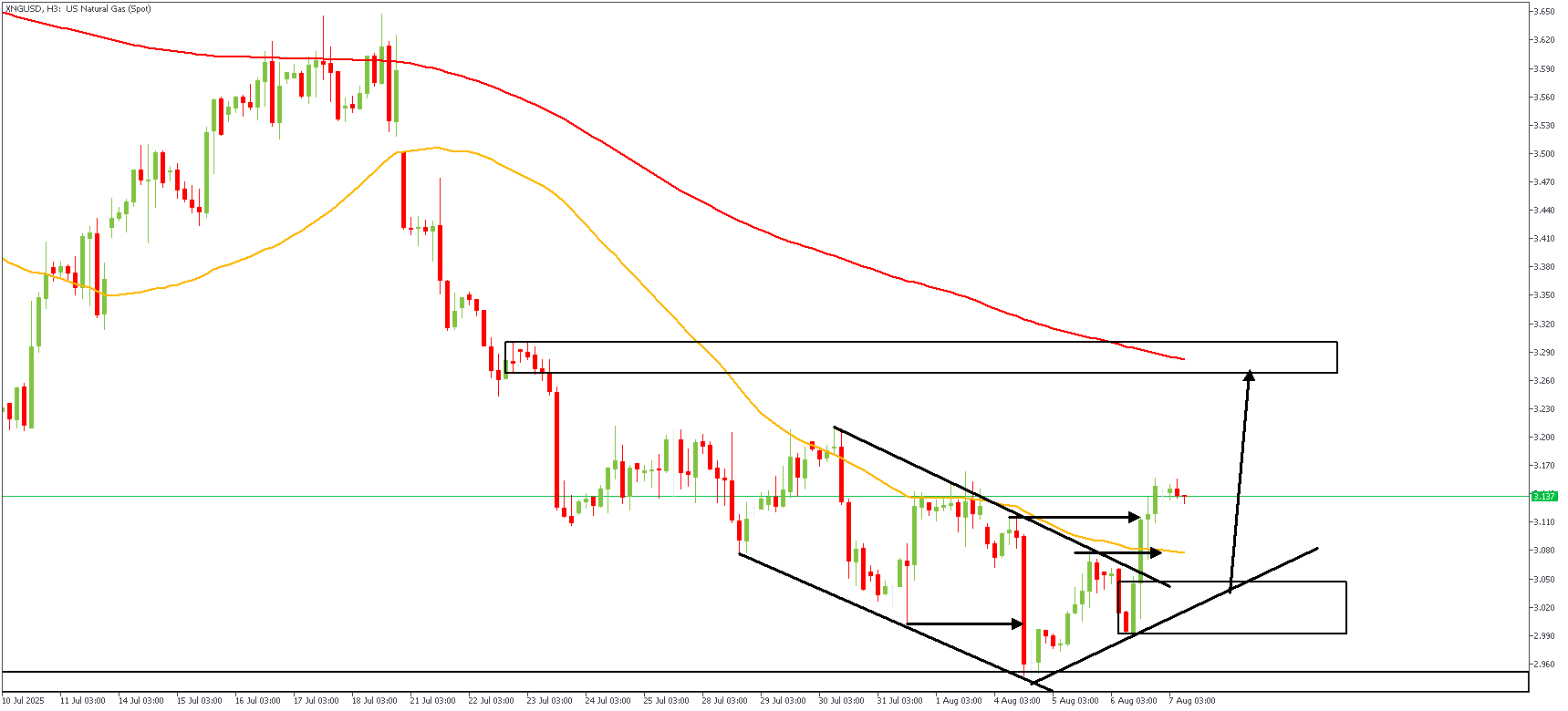

XNGUSD H3 Timeframe

On this XNGUSD 3H chart:

Price has broken out of a descending wedge pattern, which historically signals a potential bullish reversal. The breakout candle was strong and impulsive, pushing above the wedge and the 20-period EMA (orange).

Post-breakout, the price entered into a minor consolidation, suggesting a possible bullish flag or continuation pattern. Immediate resistance lies near the 3.26–3.30 supply zone (highlighted by the top black box), which also aligns with the 200 EMA (red) — a dynamic and horizontal resistance confluence.

A key demand zone around 3.00–3.04 is now the primary bullish invalidation level. The recent higher low and break of the structure suggest bulls are building momentum.

Direction- Bullish

Target- 3.266

Invalidation- 2.938

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.